The final step in a real estate transaction is the closing. And on closing day, both the buyer and the seller sign the final paperwork, pay any closing costs that may be due, and the keys to the house are turned over to the new homeowner.

What Are Closing Costs?

Closing costs refer to the fees and expenses over and above the property’s price that buyers and sellers incur to finalize a real estate transaction.

Whether you’re buying or selling a home in Texas, it’s essential to understand the closing costs involved. Closing costs may include loan origination fees, appraisal fees, discount points, title searches, title insurance, surveys, taxes, and deed recording fees.

Who Pays Closing Costs in Texas?

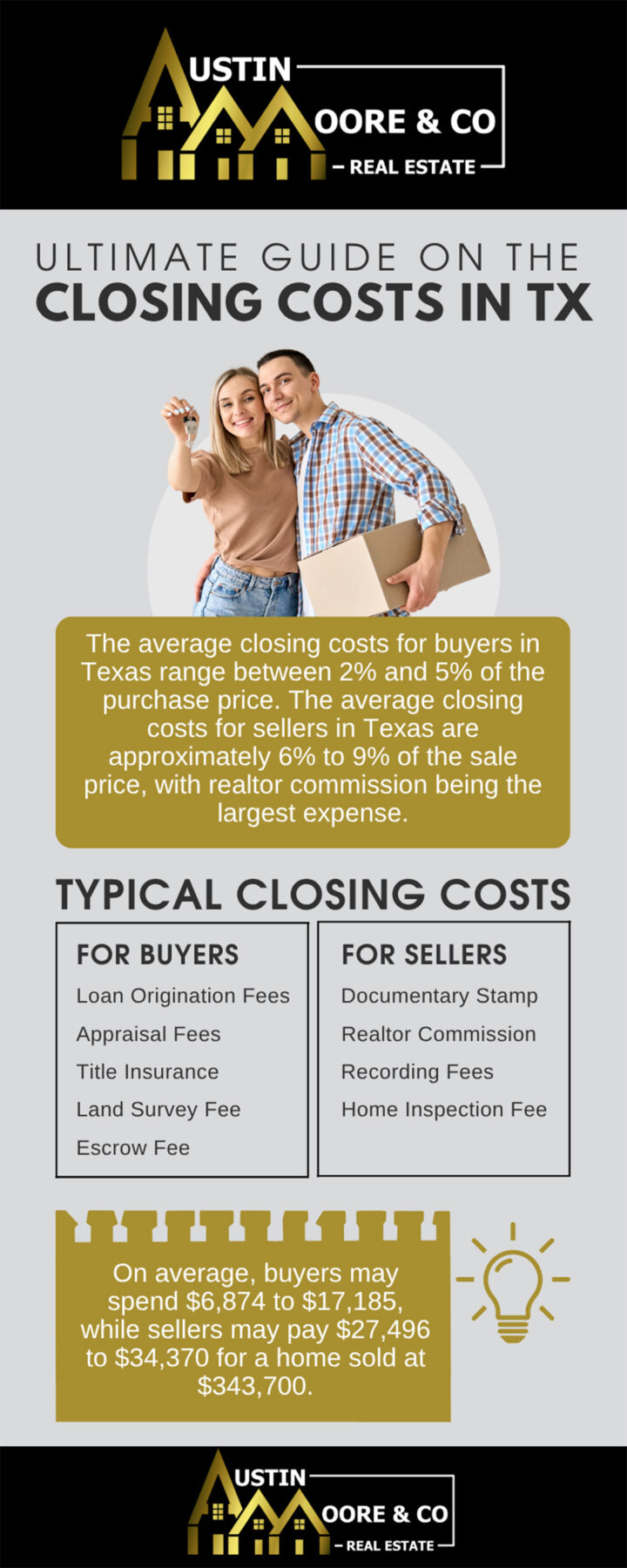

Closing costs in Texas are shared by both buyers and sellers. On average, buyers may spend $6,874 to $17,185, while sellers may pay $27,496 to $34,370 for a home sold at $343,700.

By law, lenders are required to provide buyers with a closing disclosure three business days before the scheduled closing date.

Typical Closing Costs for Buyers

For home buyers, one of the important questions to ask is, “How much are closing costs in Texas?” The average closing costs for buyers in Texas range between 2% and 5% of the purchase price.

Let’s enumerate the typical closing costs for buyers in the Lone Star State.

Buyer Closing Costs in Texas

Loan Origination Fees

Origination fees are paid to the lender or the finance company to execute the loan with other respective documentation and legal formalities. The loan origination fee is 1% of the buyer’s mortgage loan amount.

Title Insurance

Title insurance protects the buyer against loss due to outstanding taxes, unpaid dues, default in the title, or any violations belonging to previous owners. Title policy cost in Texas is around $200 to $250.

Land Survey Fee

Land survey fee is not a part of closing costs in other states. Only Texas and Florida require buyers to conduct this survey when buying a house. Minimum charge is $250 and may go up further depending on the size of the land.

Escrow Fee

This is the fee paid to the escrow agent, an unbiased party that carries out the property transactions between the buyer and the seller. The buyer is required to park some amount with the escrow agent in order to carry out the transaction smoothly.

Typical Closing Costs for Sellers

The average closing costs in Texas for sellers are approximately 6% to 9% of the sale price, with realtor commission as the largest expense.

Below are the typical closing costs for sellers in Texas.

Seller Closing Costs in Texas

Realtor Commission

The seller pays the realtor a commission of approximately 5% to 6% of the agreement value.

Recording Fees

The seller pays this fee in order to record the real estate transaction. In Texas, the fee could be range between $600 to $700, varying from county to county.

Home Inspection Fee

A home inspection is conducted to identify any major defects and issues in the property, such as plumbing issues, water damage, mold, appliance malfunction, etc. This can be done before the property is listed on the market or before the closing. Home inspection cost in Texas typically costs around $400 to $600.

Documentary Stamp

Documentary stamps refer to the excise tax levied on the documentation that transfers the property from the seller to the buyer.

Who Pays What in Texas?

In Texas, both the buyer and the seller pay certain closing costs at the end of the real estate transaction. The seller typically pays a majority of the real estate commission. Other fees, like the title insurance and land survey fee, are paid by the buyer.

Some closing costs are negotiable, while others are non-negotiable, such as taxes charged by the state or local jurisdiction.

How to Reduce Closing Costs

Closing costs are a significant amount in a real estate transaction for buyers. The average closing costs for buyers in Texas range between 2% and 5% of the purchase price.

Here are some ways home buyers in Texas can reduce closing costs:

1. Compare Loan Estimates

After a buyer completes a mortgage application, they receive a loan estimate from their lender in three days. This document lists costs like loan amount, interest rate, and service fees. Buyers can look for alternate service providers who charge lower fees.

3. Request for Seller Concessions

The buy can request the seller to cover some or all of the closing costs. The maximum concessions a seller can provide are between 3% and 6% of the home’s sale price.

4. Get Assistance from Brokers

The buyer can obtain incentives, such as grants or rebates, from real estate agents. There are assistance programs that may include forgivable loans to cover the costs, and one’s eligibility criteria are available at state housing finance agencies.

Conclusion

The closing costs in Texas are mandatory fees that should be paid by both the buyer and the seller. Working with a reliable real estate agent can help you determine and understand these expenses so you can effectively budget for these, whether you’re buying or selling.

If you need assistance with your real estate transaction, I can help. Please give me a call today at 903-500-0017 or send me an email at austin@austinmooreandcompany.com to schedule an appointment.

Frequently Asked Questions

-

Are closing costs higher for buyers or sellers in Texas?

In Texas, closing costs are typically higher for sellers than for buyers. Sellers can expect to pay around 6% to 9% of the home's purchase price, while buyers typically pay 2% to 5%. -

Can I roll closing costs into my mortgage in Texas?

Yes, it's possible to roll closing costs into your mortgage in Texas, consequently adding them to the total loan amount. While this reduces the amount you need to pay upfront at closing, it results in a higher overall cost of borrowing. -

Do I need an attorney to close in Texas?

No, an attorney is not legally required for a real estate closing in Texas.